$1000 in 5 Stocks $1,000 in just five stocks could eventually replace your full‑time income, you’re in the right place. This isn’t hype. No “get rich quick” bait. No “$75 will make you a millionaire by Friday.” Just a grounded approach that shows what’s possible with growth stocks, compound returns, and a plan you can actually stick to.

If you follow this guide, you’ll understand which stocks to watch, how to structure your portfolio, and realistic timelines to replace your income—all backed by data and real strategies.

I pulled inspiration from one of the most watched investing videos online, analyzed the logic behind the picks, and built a step‑by‑step roadmap, with real data where possible and resources you can use to verify everything yourself.

Let’s dive in.

Table of Contents

- Why Investing $1000 Isn’t Crazy — It’s Strategy

- How Growth Stocks Can Outpace Your Job Income

- The 5 Stocks That Could Replace Your Job

- Realistic Return Scenarios and Timeframes

- How to Build Your Plan (Step by Step)

- Risk Considerations and Safety Nets

- Tools and Resources to Track Your Progress

- FAQ — The Truth Behind Common Questions

- Final Thoughts

Why Investing $1000 Isn’t Crazy — It’s Strategy

$1000 in 5 Stocks

Here’s the thing: putting $1,000 into the stock market won’t replace your paycheck overnight. Anyone promising that is selling something — not helping you invest.

But if you pick your stocks smartly and give them time, that $1,000 can snowball into something meaningful.

Let’s break down the core concept with an example of compound growth:

Compound Growth in Action

If your portfolio earns an average of 15% per year, here’s what happens:

- After 10 years → $1,000 becomes about $4,050

- After 20 years → $1,000 becomes about $16,400

If you’re consistently adding to that $1,000, say another $1,000 every year, the numbers get much more exciting. Compound growth isn’t linear — it accelerates over time.

For a quick primer on how compounding works, check out this post from Investopedia on compound interest.

The big idea here: time + returns + consistency = power.

How Growth Stocks Can Outpace Your Job Income

$1000 in 5 Stocks

Your job pays you a steady income. Growth stocks, when chosen well, grow your money in a way your paycheck never can.

Why? Because stocks reinvest profits into expanding their business — hiring people, innovating products, gaining market share — and that growth gets priced into the stock market.

But not all growth stocks are created equal.

Some grow slowly and steadily (think utilities). Others can explode from being little known to industry leaders — especially in tech, AI, security, cloud infrastructure, and emerging finance.

What Makes a Good Growth Stock?

When I look for a stock that might help replace your income, I care about:

- Revenue growth — is the business actually expanding?

- Market opportunity — how big can this company get?

- Competitive advantage — does it have something others don’t?

- Valuation — is it priced fairly relative to growth?

- Earnings trends — are profits rising?

Sites like Morningstar and Yahoo Finance (e.g., links for each stock in this article) are great places to track this data in real time.

The 5 Stocks That Could Replace Your Job

$1000 in 5 Stocks

Here’s the lineup most aligned with long‑term growth themes — cybersecurity, AI infrastructure, global tech, voice AI, and next‑generation finance.

1) Zscaler (ZS)

Sector: Cybersecurity

Why it matters: Cybersecurity isn’t going anywhere. In fact, as more business goes digital, cyber threats are increasing — and companies are spending more to stop them.

Zscaler is one of the leaders in cloud‑native security. They helped pioneer the shift from traditional network security to a zero‑trust model, meaning companies verify everything before allowing access — even inside the network.

Why Zscaler Could Grow Big

- Cloud security is expected to grow faster than traditional IT security.

- Zscaler has a high customer retention rate (companies don’t like switching security providers).

- It’s used by many Fortune 500 companies.

This company isn’t a household name, but security dollars are almost recession‑proof because companies can’t cut them without putting their business at risk.

Quick reference:

Zscaler on Yahoo Finance: https://finance.yahoo.com/quote/ZS/

Zscaler at MarketWatch: https://www.marketwatch.com/investing/stock/zs

What to Watch

Look at revenue growth rates and customer additions each quarter. If both continue upward, the stock could stay on a strong trajectory.

2) Astera Labs (ALAB)

Sector: Networking hardware & infrastructure

Why it matters: Data centers are the backbone of cloud computing and AI. The demand for fast, reliable networking gear has exploded.

Astera Labs makes silicon and software that helps data centers move huge amounts of data fast — and the supply side of that business hasn’t kept up.

The Growth Logic

Data centers run everything from social media to cloud apps to streaming. And tech giants like Amazon and Google don’t want any bottlenecks.

Astera is positioned right in that sweet spot between data traffic demand and supply limitations. If networking equipment becomes a constraint on AI buildouts, companies with strong offerings like Astera could benefit.

To track it:

Astera Labs on Yahoo Finance: https://finance.yahoo.com/quote/ALAB/

Data on AI hardware demand from Gartner: https://www.gartner.com

(Note: Some resources like Gartner may require a subscription.)

3) Alibaba (BABA)

Sector: E‑commerce, cloud computing, AI

Why it matters: Alibaba is China’s tech behemoth — kind of like Amazon and Google rolled into one.

Even with regulatory uncertainty, China’s digital economy is huge, and Alibaba’s cloud and AI businesses could grow for years.

Growth Drivers

- Massive online shopping market.

- Cloud computing demand in China is picking up.

- AI development inside the company gives it another long‑term pillar of growth.

Because of geopolitical uncertainty, this isn’t a “safe” stock, but high risk often means high reward — which is exactly what long‑term growth investors seek.

Check it out:

Alibaba on Yahoo Finance: https://finance.yahoo.com/quote/BABA/

4) SoundHound AI (SOUN)

Sector: Voice AI & Speech Technology

Why it matters: Voice user interfaces are everywhere — cars, smart speakers, apps. Most companies still translate speech to text then analyze it. SoundHound does something different: it converts speech directly into machine understanding through AI.

That’s a big deal because it removes latency and improves real‑world responsiveness.

What Makes SoundHound Interesting

- Partnerships with carmakers and consumer brands.

- If the voice AI market really takes off, companies with patented tech stand to benefit the most.

- The market opportunity for voice AI is massive — potentially tens of billions of dollars.

SoundHound is still small relative to peers — which is why it’s higher risk but higher potential.

Explore more here:

SoundHound on Yahoo Finance: https://finance.yahoo.com/quote/SOUN/

5) iShares Ethereum Trust (ETHA)

Sector: Crypto & Tokenized Asset Exposure

Why it matters: While cryptos themselves don’t pay dividends or earnings, Ethereum is the backbone of tokenization — the next evolution in digital finance.

Tokenization could dramatically change how assets trade and are financed, and Ethereum is where most tokenized assets live today.

ETHA isn’t direct crypto ownership — it’s an ETF‑like vehicle that tracks Ethereum’s price. That can make it easier for traditional investors to get exposure without owning Ethereum directly.

How This Fits Your Income Plan

If Ethereum grows, ETHA grows — and the gains could be multiples larger than typical stocks. But that also means bigger draws in downturns.

For more on Ethereum’s role in finance, see:

✔ Ethereum.org basics: https://ethereum.org/en/

✔ Tokenization explained by ConsenSys: https://consensys.net/blog

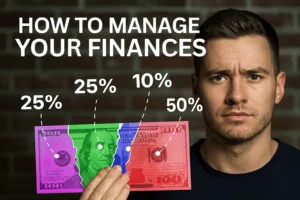

Realistic Return Scenarios and Timeframes

$1000 in 5 Stocks

Let’s be straight: retiring off these five stocks isn’t guaranteed. But let’s model a few scenarios so you can decide for yourself.

Scenario A: 15% Annual Return

If all five stocks average 15% per year, and you add $1,000 annually, your portfolio after:

- 5 years → ≈ $7,000 – $10,000

- 10 years → ≈ $25,000 – $35,000

- 15 years → ≈ $70,000 – $90,000

Not enough to replace a full‑time job… yet.

Scenario B: 25% Annual Return

If instead they average 25% per year (higher risk, higher gain):

- 5 years → ≈ $11,000 – $16,000

- 10 years → ≈ $70,000 – $95,000

- 15 years → ≈ $300,000 – $400,000

At that point, if you switch to safer investments that pay a 4‑5% yield (like bonds or dividend stocks), your portfolio could generate $12,000–$20,000 per year in income just by living off the yield.

Scenario C: A Breakout Performer

What if one of these stocks goes nuclear? That’s the gamble — and the opportunity.

Example: if ETHA or SoundHound doubles or triples in a short window, your overall return jumps dramatically because of compounding.

That’s why diversification and consistency matter — and why adding more than just $1,000 a year helps significantly.

How to Build Your Plan (Step by Step)

$1000 in 5 Stocks

Okay, here’s how you actually execute this idea:

Step 1 — Open a Brokerage Account

If you don’t already have one, choose a platform that offers no‑commission trades, good research tools, and low fees. Examples include:

- Charles Schwab

- Fidelity

- Interactive Brokers

(Your choice will depend on your location and tax situation.)

Step 2 — Set a Contribution Schedule

You don’t have to time the market — just be consistent. Decide:

- How much you’ll invest each month/year

- Which stocks you’ll prioritize when you add funds

Consistency beats timing every time.

Step 3 — Track Earnings and Growth

Create a simple spreadsheet or use tools like:

✔ Yahoo Finance Portfolio Tracker

✔ Morningstar Portfolio

✔ Google Sheets with linked price APIs

Watch where your money is going and how it’s performing.

Step 4 — Stay Educated

Read earnings reports, listen to quarterly calls, and keep up with industry trends.

For cybersecurity trends, check Cybersecurity Ventures or Gartner.

For AI developments, sources like MIT Technology Review and TechCrunch are useful.

Risk Considerations and Safety Nets

$1000 in 5 Stocks

Investing is not without risk. Here’s what to watch out for:

Market Volatility

Tech stocks can swing wildly. If you can’t sleep at night because your portfolio dips 30%, you need a plan:

- Diversify beyond high‑growth names over time.

- Set stop‑losses if you’re uncomfortable with drawdowns.

Sector Risk

Each of these five is tied to a theme:

- Security

- AI infrastructure

- Cloud computing

- Digital interfaces

- Blockchain finance

That’s a lot of tech exposure. Eventually, consider adding:

✔ Dividend stocks

✔ Index funds

✔ Bonds or bond ETFs

Don’t Bet the Farm

Never invest money you need in the next 3–5 years into high‑growth equities. That’s just common sense.

Tools and Resources to Track Your Progress

Here’s a quick toolbox to stay on top of this plan:

| Tool | What It’s Good For |

|---|---|

| Yahoo Finance | Portfolio tracking, news, charts |

| Morningstar | Deep fundamental data |

| Seeking Alpha | Analyst debates and earnings transcripts |

| TradingView | Charting & technical analysis |

| Ethereum.org | Understanding the crypto foundation |

Plus, bookmark SEC filings for each company to read quarterly and annual reports.

FAQ — The Truth Behind Common Questions

Will $1k really replace my job?

Not immediately. But with time, consistency, and favorable returns, it can become a significant income stream.

What rate of return do I need?

There’s no magic number, but higher returns (20–30%+) shorten the timeline. Those returns aren’t guaranteed — that’s why diversification and persistence matter.

Should I reinvest dividends?

Yes, if your goal is maximum growth, reinvesting dividends compounds your returns.

Is crypto part of this plan?

Only via ETHA here — indirect exposure. Direct crypto investing carries separate risks.

Final Thoughts

Putting $1,000 into five growth stocks with a plan to replace your job isn’t fantasy — it’s a strategic game. You’re not trying to get rich overnight. You’re building leverage into your financial future.

If you treat this like a journey — investing consistently, learning continuously, and balancing risk — you can build a portfolio that generates meaningful income.

Just remember:

Patience isn’t passive — it’s strategic.

⚠️ IMPORTANT NOTICE: This content is not investment advice. All opinions regarding the US market (Stocks/REITs/ETFs) are strictly for educational purposes. Investing in dollars and variable income assets involves risk of loss. Do your own research (DYOR) or consult a financial expert before making decisions.